Advocacy

STEB Confirms Lower CLR

On May 17, 2023, the State Tax Equalization Board (STEB) affirmed a Common Level Ratio (CLR) for 2022 at 63.5% in Allegheny County. This lower percentage will benefit all real…

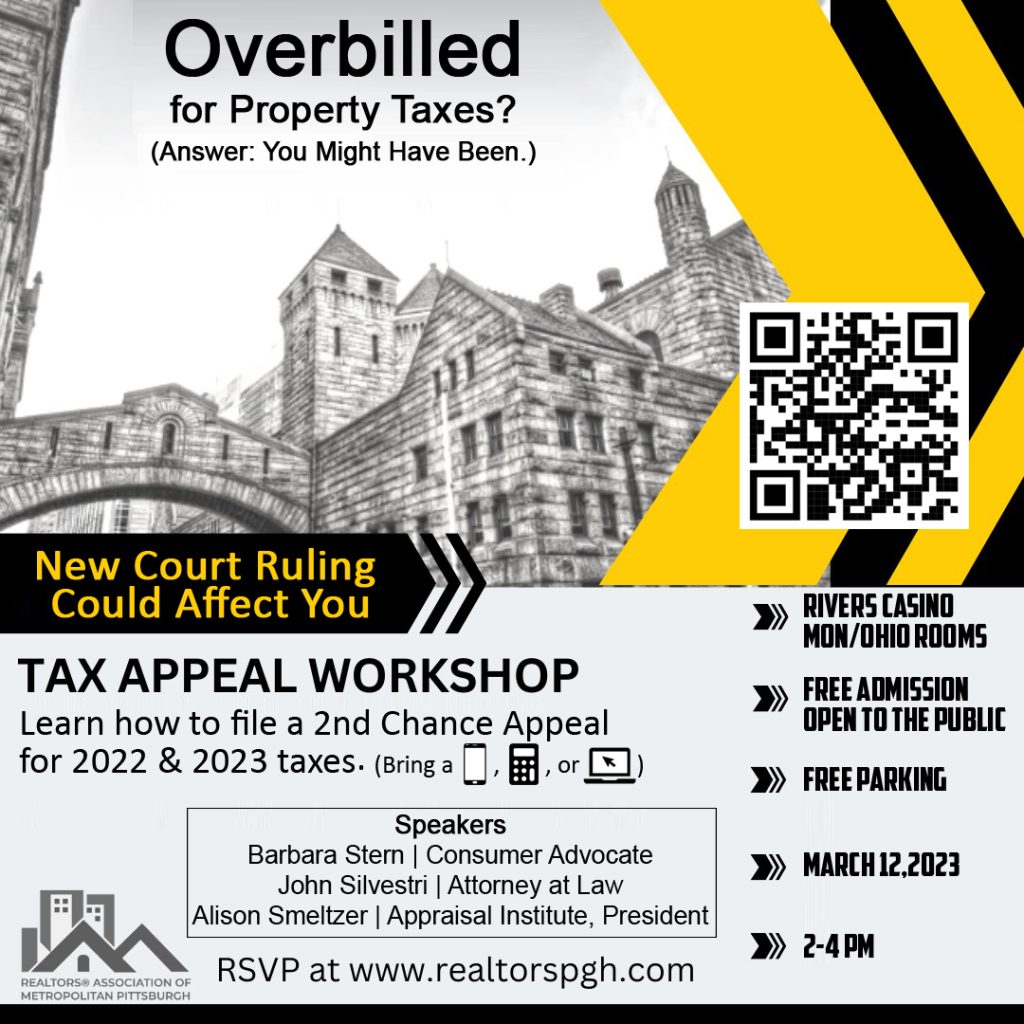

Read MoreTax Appeal Workshop Recap

RAMP held a Allegheny County Property Tax Appeal Workshop on Sunday, March 12th at the Rivers Casino. The workshop was open to REALTORS®, as well as, the public. Our featured…

Read MoreTax Appeal Workshop

Recent homebuyers in Allegheny County are being over-assessed for their property taxes. There is a special period for homeowners to apply for an opportunity to appeal their property tax assessment…

Read MoreAllegheny County Assessment Appeals for 2022 Tax Year

Real Estate consumers in Allegheny County have a new opportunity to potentially lower their property tax bill. Favorable legal action has adjusted the Common Level Ratio, that determines assessed taxable…

Read MoreR-PAC Fundraiser: Drag Queen Bingo

It’s Back! After a pandemic-forced absence, we are bringing back a popular fundraiser for R-PAC, Drag Queen Bingo. Enjoy the fun of bingo with the excitement of drag queens dancing…

Read MoreCommunity Meetings on Property Assessments and Owners’ Rights

Allegheny County Controller Corey O’Connor announced dates and locations for a series of information sessions on property owners’ rights in the County’s property assessment and appeals process. O’Connor is partnering…

Read MoreAdvocacy Victory: 1031 Like-Kind Exchanges

Pennsylvania Realtors® scored a huge advocacy win this week. The Pennsylvania General Assembly approved legislation that will finally recognize 1031 like-kind exchanges in the commonwealth and provide the tax deferral…

Read MoreVictory for Allegheny County Homebuyers

As you may be aware by recent news reports, consumers that had recently purchased homes filed suit against Allegheny County relative to real estate tax assessment appeals. The consumer plaintiffs,…

Read MoreRPAC? What does it do for me?

We are frequently asked why we request that our members contribute to RPAC, the REALTORS® Political Action Committee. We often hear, “what does it do for me?” RPAC supports candidates…

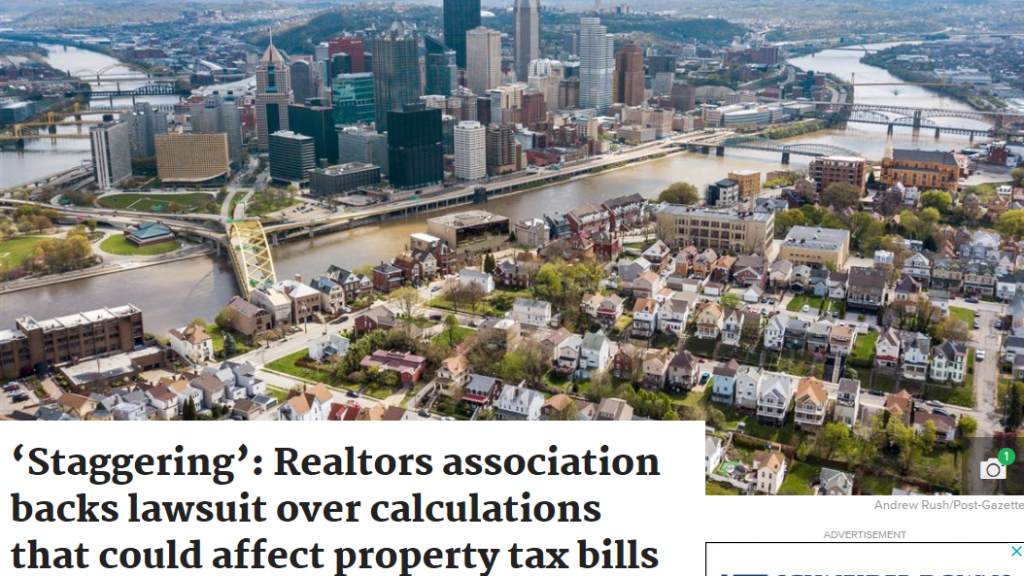

Read MoreRAMP Joins Lawsuit

Earlier this week, the REALTORS Association of Metropolitan Pittsburgh joined a lawsuit against Allegheny County. You may read more about the case in an article published in the Pittsburgh Post-Gazette.

Read More