Posts Tagged ‘allegheny county’

Government Relations Committee

STEB Confirms Lower CLR

On May 17, 2023, the State Tax Equalization Board (STEB) affirmed a Common Level Ratio (CLR) for 2022 at 63.5% in Allegheny County. This lower percentage will benefit all real…

Read MoreTax Appeal Workshop Recap

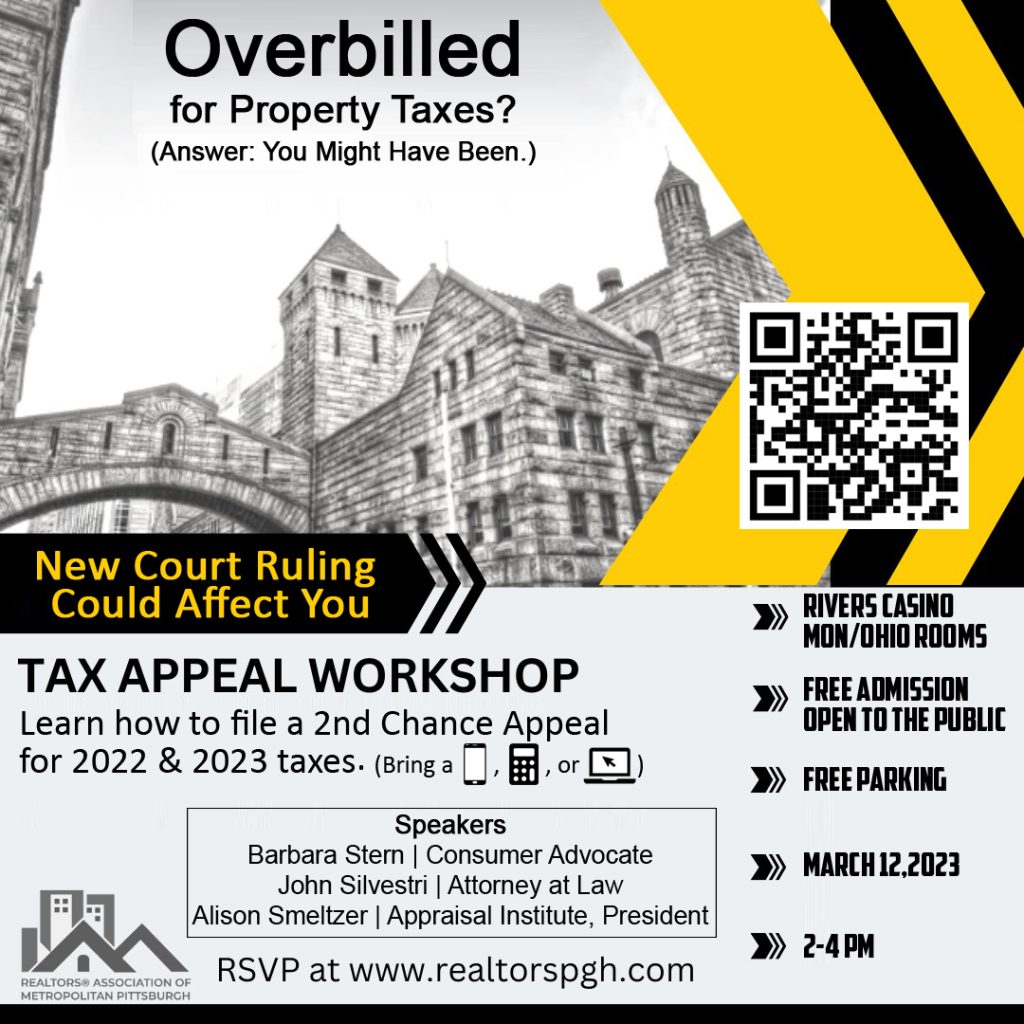

RAMP held a Allegheny County Property Tax Appeal Workshop on Sunday, March 12th at the Rivers Casino. The workshop was open to REALTORS®, as well as, the public. Our featured…

Read MoreTax Appeal Workshop

Recent homebuyers in Allegheny County are being over-assessed for their property taxes. There is a special period for homeowners to apply for an opportunity to appeal their property tax assessment…

Read MoreAllegheny County Assessment Appeals for 2022 Tax Year

Real Estate consumers in Allegheny County have a new opportunity to potentially lower their property tax bill. Favorable legal action has adjusted the Common Level Ratio, that determines assessed taxable…

Read More